Understanding the Penalties for Not Linking it’s important to know the rules around linking and maintaining it. Not following these rules can lead to some unexpected issues. Let’s break it down in simple terms.

Why You Should Never Miss Linking Your Aadhaar to PAN

Linking Aadhaar to your PAN is not just a formality it’s a legal requirement. Here’s why it matters

Income Tax Filing Linking your Aadhaar to PAN is mandatory to file your tax returns. Tax Refunds and Deductions If you miss the link, you could face higher tax deductions Without Internet Access.

The Hidden Costs What Happens If You Don’t Link Aadhaar to PAN

Failing to link Aadhaar to PAN on time comes with its own set of consequences. These penalties are designed to encourage timely compliance.

₹1,000 Late Fee: If you missed the deadline, you can still link Aadhaar to PAN but with a ₹1,000 late fee.

₹10,000 Fine: Using an inoperative PAN for financial transactions can attract a fine of ₹10,000 per transaction.

Financial and Legal Impacts: Not linking Aadhaar to PAN can affect your financial transactions, making it difficult to open bank accounts or invest in mutual funds.

Needs to Link Aadhaar

Exempt Groups: People living in Assam, Jammu & Kashmir, or Meghalaya, NRIs, those above 80, and non-citizens of India.

If you’re not exempt: It’s important to take action and avoid penalties.

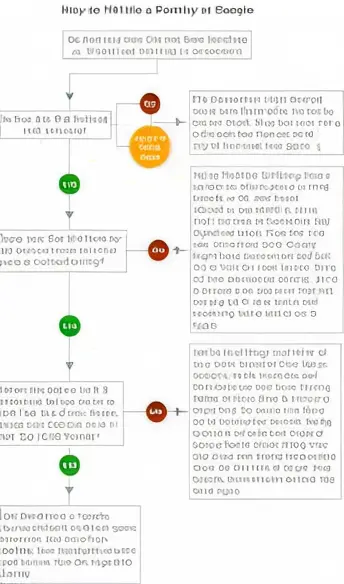

How to Easily Link Your Aadhaar to PAN

Visit the e-Filing Portal: Go to the official Income Tax website.

Enter Required Details: Provide your PAN and Aadhaar number.

Verification: Enter the OTP sent to your Aadhaar-linked mobile number.

Completion: Submit and complete the process.

Why Linking Aadhaar to PAN is Crucial

Prevent Fraud: Linking helps verify your identity and reduces the chances of fraudulent activities.

Simplify Financial Processes: Everything from tax filing to bank accounts becomes easier when your Aadhaar and PAN are linked.

₹10,000 Fine: Using an inoperative PAN for financial transactions can attract a fine of ₹10,000 per transaction.

Aadhaar vs PAN What’s the Connection

While both Aadhaar and PAN are vital for identity and tax purposes, they serve different roles.

Aadhaar is your personal identification number, and PAN is used for tax-related activities.

Linking them brings more efficiency in tax filings and tracking financial transactions.

Top Tips for Smooth Aadhaar-PAN Linking

Don’t Wait Until the Last Minute: Avoid rushing and pay the late fee by linking early.

Keep Your Details Updated: Ensure your mobile number and email are up to date on your Aadhaar.

Double Check: Verify your details on the portal to avoid mistakes.

Your PAN Becomes Inoperative

Reactivate Your PAN: You can reactivate your PAN by linking it to Aadhaar and paying a ₹1,000 late fee.

Time Frame: It typically takes around 30 days to reactivate your PAN once you complete the linking process.

Is it mandatory to link Aadhaar to PAN?

Yes, it is mandatory under the Indian government’s regulations. Not doing so will make your PAN inoperative and could affect your tax filings and financial transactions.

What if I miss the deadline to link my Aadhaar to PAN?

If you miss the deadline, you will have to pay a ₹1,000 late fee to complete the linking process.

Can I link Aadhaar to PAN if I don’t have an Aadhaar-linked mobile number?

No, you need an OTP sent to your Aadhaar-linked mobile number. If you have changed your mobile number, you’ll need to update it first at an Aadhaar center.

How long does it take for PAN reactivation after linking Aadhaar?

Once you link Aadhaar to PAN, reactivation typically takes about 30 days.

Can I use an inoperative PAN for tax filings?

No, you cannot use an inoperative PAN for tax filing or financial transactions. You must link Aadhaar to activate it.

Final Words

In summary, linking your Aadhaar to PAN is more than just a regulatory requirement—it’s an essential step to streamline your financial and tax processes. While there are penalties for not linking them on time, the process itself is simple and quick. Take the time to do it, and you’ll avoid any unnecessary fines or disruptions to your financial activities.